Hamptons Developer Jeremy Morton Faces Default Claims

Jeremy Morton caused a stir when he picked up two pieces of prime retail space in Sag Harbor about a year ago.

The developer has been a quiet player in the East End’s restaurant and commercial scene in recent years. He purchased local hotspots Ruschmeyer’s and Rick’s Crabby Cowboy Café in 2020 and 2021, respectively, and bought — and later sold — Morty’s Oyster Stand in Montauk.

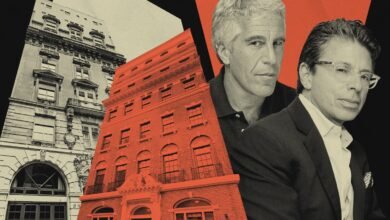

In 2024, he made headlines when he spent $8.4 million on Southampton Village’s largest commercial property on a prime corner, and sparked more attention later that year when he paid $30 million for two properties in downtown Sag Harbor. But while he pursues multi-million-dollar redevelopment plans for the site, lenders have claimed Morton stopped repaying the debts.

Atlanta-based U.S. Strategic Capital, a short-term lender to small businesses, filed a lawsuit this month to foreclose on two of Morton’s East Hampton properties. The suit, filed in Suffolk County, claimed his development firm, Excelsior Development NY, defaulted on a $3.8 million loan from July.

Morton personally guaranteed the loan, allowing USSC to pursue the developer’s personal assets if a potential foreclosure sale doesn’t cover his debts, which the suit places at more than $4 million.

A foreclosure sale would also need to cover the senior loans on Morton’s homes, according to the complaint. The developer took out a mortgage of over $5 million last March on the property at 38 Chatfields Ridge Road, which appears to be one of his personal residences. He also took out a mortgage with a principal amount of around $3.8 million in 2023 on the home at 126 Long Lane.

“I am addressing these matters in the ordinary course,” Morton said in a statement. “I take my obligations seriously and will continue to work constructively with all stakeholders as issues are evaluated and resolved.”

Nonpayment accusations land on local developer

One day after USSC’s lawsuit, Morton was hit with another complaint, claiming he defaulted on roughly $200,000 worth of small business loans that he personally guaranteed in 2021. The loans were tied to an entity with the same address as Provisions Natural Foods, a local grocery chain with locations in Sag Harbor and, formerly, Water Mill. The Water Mill store announced in 2024 that it would not be reopening, and would instead debut a new branch at the Southampton commercial corner Morton bought in 2024.

The action followed a roughly $330,000 judgment secured by a building supplies company against Morton’s development firm last month over unpaid materials purchased last summer. Morton personally guaranteed the debt and signed a confession of judgment, allowing the judgment to be entered against him.

The two lawsuits and confession of judgment claim that Morton stopped making payments — for the supplies and on his loans — in November.

It was around this time that Morton’s development firm took out a cash advance from Simply Funding, a source of short-term capital that buys discounted receivables from companies. Simply Funding paid Morton $310,000 for $415,000 worth of receivables, requiring him to repay roughly $10,000 each month until hitting the $415,000 he owed, according to documents in a lawsuit filed last month by Simply Funding.

But Morton only made it two weeks before he stopped making payments, Simply Funding claimed. The developer also signed a confession judgment and personally guaranteed the amount owed, which is almost $400,000, according to a court judgment.

All told, Morton has personally guaranteed roughly $5 million in loans and other debts in the last year, according to these four filings.

For now, Morton is advancing on his plans to redevelop the downtown Sag Harbor retail properties at 2 Main Street and 22 Long Island Avenue. He secured a $40 million loan in February 2025 from Mavick Capital to fund the acquisition and redevelopment of the properties.

But beyond appearing at local meetings to curry favor and discuss his plans for the properties, the developer has avoided making public waves for his projects. He previously declined to confirm the acquisition to 27East.

“People are buying properties in the Hamptons every day,” he told the outlet. “Is there some kind of obligation for the media to write about it?”

Read more

East End restaurateur lands $40M loan for Sag Harbor redevelopment

East End restaurateur Jeremy Morton appears to scoop up Sag Harbor parcels

Montauk hotspot quietly for sale after losing liquor license