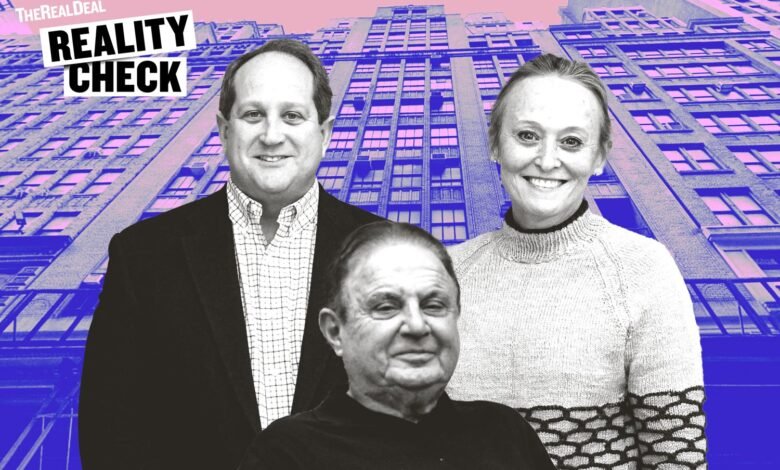

Property Flip Pays Off for Cayre Family, NYC, State, MTA

It’s enough to make any real estate hater burn: Cayre Equities just sold 254 West 35th Street for 62 percent more than they had paid just 14 months before, as my colleague Liz Cryan reported.

The key to the $10 million increase was that between the purchase and the sale, the city rezoned Midtown South, including Cayre’s Garment District building.

What should we make of this?

One thing that real estate’s critics dislike about rezoning is that it adds value to properties. It creates wealth out of thin air for whomever was lucky or smart enough to own a rezoned parcel at the time.

Critics call buyers of land that might be rezoned “speculators,” a derogatory term that suggests investors are trying to make money without doing any real work. They also claim property speculation makes the city more expensive.

This is stupid on several levels.

First, rezoning is necessary to make the best use of land when circumstances change, as they have in the Garment District. Midtown West is now much more valuable to society as residential or office space than as manufacturing.

City politicians resisted rezoning it for decades in a misguided attempt to save textile jobs, but nearly all of those jobs disappeared or moved elsewhere anyway. The government was also slow to rezone manufacturing districts in Long Island City, Gowanus, Inwood and Red Hook.

Second, “speculators” play a useful role in the market by buying properties that someone wants to sell. Markets need liquidity. If Mrs. Jones wants to cash out a longtime family property and retire to Arizona, she needs buyers. To her, they are not speculators, but investors who make her golden years truly golden. (Cayre bought 254 West 35th from Gonca Chelsea’s LLC.)

Third, every time a property is sold, the city, state and Metropolitan Transportation Authority collect transfer taxes. Critics who believe sales and property upgrades make the city more expensive should consider how much higher their subway fare would be, or if garbage pickup would be free, if not for transfer taxes.

State and city transfer taxes on sales of $25 million or more range from 1.4 percent to almost 6 percent. The Cayre family’s sale of 254 West 35th generated $773,665 in transfer taxes — 3 percent of the sale. Its purchase in 2024 produced $528,912 in transfer taxes.

If you believe the family did nothing to make millions of dollars on its flip, ask yourself what the government did to reap $1.3 million.

It doesn’t take zero work to buy and sell a property. The buyer is putting money at risk rather than, say, buying a Treasury note paying a guaranteed 4 percent. Acquiring investment properties involves a lot of due diligence, networking and fundraising from investors, among other things. It takes a lot more time than buying an index fund with a few mouse clicks.

The Cayres made a profit, but it could also be called earnings. It’s not passive income. It’s money derived from work.

Read more

The Daily Dirt: The celebrated, vilified art of combining homes

The Daily Dirt: Watch out for this fiscal cliff

Would Mamdani kill the luxury market?