Summit Wins Fight for Pinnacle Units

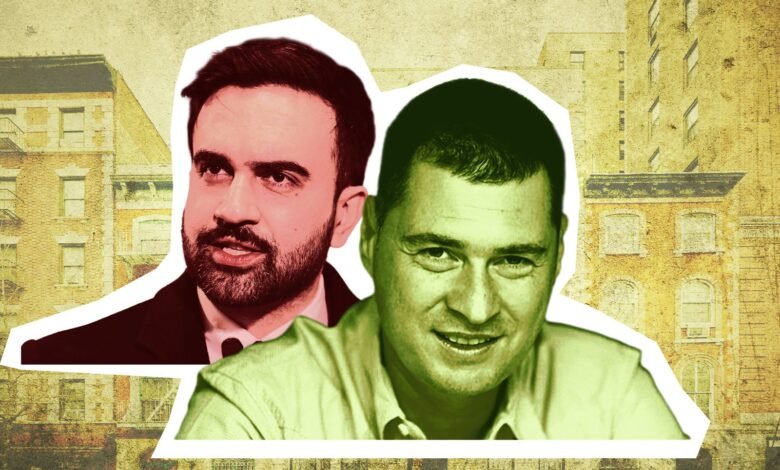

Summit Properties was confirmed as the buyer of 5,151 mostly rent-stabilized apartments from Pinnacle Group in a Friday hearing. Pinnacle, run by Joel Wiener, placed the apartments in bankruptcy. Summit will pay $451.3 million for the portfolio.

The hearing marks the end of a weekslong battle, with Pinnacle and Summit on one side and the Mamdani administration and tenants on the other. The latter group tried unsuccessfully to stop, pause and delay the sale, hoping for a tenant-aligned bidder or concessions from Summit.

Bankruptcy judge David Jones considered their argument that Summit had not adequately made assurances that it could perform as the buyer and fix up the portfolio. But ultimately he decided to confirm the purchase, after Flagstar Bank agreed hours into the hearing to extend a $3 million revolving line of credit to Summit.

The result highlights the challenges ahead for the Mamdani administration as it tries to throw its weight between private transactions. But it also shows that landlords are living in a new New York: one where the mayor can make their portfolios into political problems, and potentially win even minor concessions.

“Summit’s statements make clear its commitment to do what is needed,” Judge Jones said. “The city’s approach to this case gives me confidence that the city will monitor and police Sumit’s performance.”

Summit purchased the mostly rent-stabilized portfolio for $451.3 million, or roughly $88,000 per unit. Flagstar Bank, the largest creditor in the bankruptcy proceedings, agreed to finance about 75 percent of the acquisition and lower the interest rate.

The city first raised concerns about the auction during the Adams administration, when the housing department asked for time for a “preservation-focused” buyer to put together a bid.

But Mamdani raised the profile of the sale and made the auction a political rallying point. His administration originally asked to delay the auction, but the judge rejected that effort. At the hearing, the city and tenants’ lawyers raised questions about Summit’s financial wherewithal to cure violations, history as a property owner, and limited experience running real estate in New York.

But Judge Jones sided with Summit, saying the company had fielded a “serious and reasonable sounding plan” to improve property conditions.

Summit chair Zohar Levy said the company plans to spend $10 million in the first year fixing violations and addressing maintenance needs, with $3 million specifically on existing violations. It plans on addressing half the violations in the first two months of the sale and the other half within six months of the sale. Within five years, the company plans to spend $30 million in capital expenditures, or about $5,824 per unit.

Although the city raised concerns that Summit’s current New York properties have thousands of violations, Levy said at the hearing that the company is just a limited partner in those properties and would have greater oversight of the new portfolio. REM Management has been engaged to manage part of the portfolio.

Judge Jones said Flagstar’s promise of a revolving $3 million line of credit was a “valuable and helpful” commitment.

It’s a mixed result for the Mamdani camp’s first big tussle with private landlords. The administration was unsuccessful in its original goal of stopping the sale and bringing on a nonprofit or tenant-focused buyer. But it was also able to slightly alter the terms of the transaction in a large multifamily portfolio purchase.

In a statement, Levy said he understood that the process had been difficult for tenants and that they are concerned about their homes.

“Today’s ruling is a new chapter, and we look forward to working with the City, our elected officials, stakeholders and residents to improve the buildings and move forward,” Levy said in the statement. “We are assembling a strong team and have the capacity, commitment and resources to succeed for everyone’s benefit.”

A spokesperson for Pinnacle Group noted that the judge’s decision is the end result of an eight-month public process. “The company, its independent chief restructuring officers and advisors appreciate the court’s recognition that this outcome, achieved in challenging circumstances, is the best available for all constituencies, and hopes the City does too,” the spokesperson said in a statement.

Neither the city nor Summit immediately responded to a request for comment.

Despite talk of a potential insider connection in the deal concerning Jonathan Wiener, brother of Pinnacle’s Joel Wiener, Jones said he was not convinced of any insider involvement.

Read more

Judge rejects Mamdani’s bid to pause Pinnacle auction, paves way for Summit takeover

Summit to take over 5K apartments from Joel Weiner’s Pinnacle